AirCredit

AirCredit:Telco-Driven BNPL & Credit Intelligence

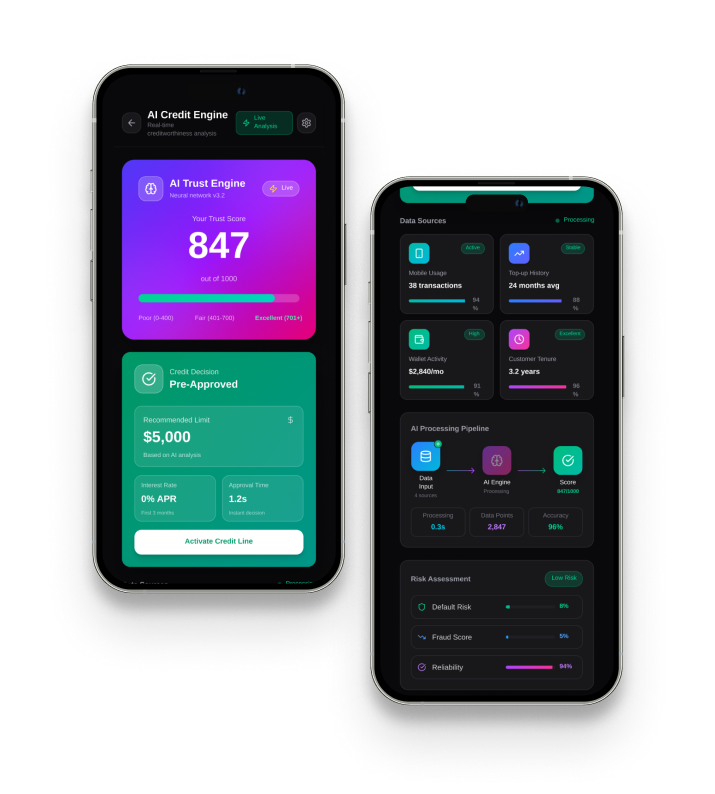

AirCredit redefines financial inclusion by transforming raw telecom data into powerful credit intelligence. By analyzing mobile behaviors, top-up patterns, and utility usage, we enable banks to offer instant BNPL and micro-loans to the unbanked with surgical precision. It’s a high-velocity bridge that turns alternative data into low-risk growth, providing credit access where traditional bureaus see only silence.